Definition of Delta

Delta is the most well known of options greeks.

Delta measures the rate of change of the underlying's price. Change in the underlying instrument's price can be quantified by delta. When the underlying goes up or down, delta measures the move of the option's market price. This allows the informed option trader the ability to manage his option position and portfolio.

Delta Measurements for Call and Put Options

For call options, delta ranges from 0 to 1.

For put options, delta ranges from 0 to -1.

Delta reflects the increase or decrease of the option's market price in response to a 1-point movement of the underlying asset price.

Call Option Delta Example

For example, consider XYZ stock that is trading at $100. The near month, at-the-money (ATM) call option is priced at $2.00. The delta is 0.48. If XYZ moves up in price from $100 to $101, delta indicates that the price of the call option will increase from $2.00 to $2.48.

For call options, the formula to estimate the option's market price based on delta is:

Change in the Call Market Price When the Underlying Increases = Delta X Change in Underlying

However, the calculation is different when the the price of the underlying goes down. For the reason's discussed below, when the underlying decreases by $1, the price of the call option does not change by the delta. The price will decrease by a lesser amount than the delta because of the effect of time and volatility.

Put Option Delta Example

Consider XYZ stock priced at $100. The near month, at-the-money (ATM) put option is priced at $2.50. The delta is -0.60. If XYZ moves down to $98, delta indicates that the price of the put option will decrease from $2.50 to $1.30.

For put options, the formula to estimate the option's market price based on delta is:

Change in the Put Market Price When the Underlying Decreases = Delta X Change in Underlying

Using the example above then

Change in Put Market Price = -0.60 X $2.00 = -$1.20.

When the underlying increases, the put delta does not estimate the put market price effectively.

Ready to find out more?

Membership is always FREE. You can upgrade anytime to get the best Algorithmic Option Trades and Systems.

Delta is Not Constant

Other factors effect delta and the price of the call or put option when the underlying price changes.

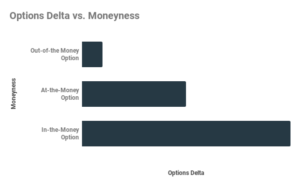

Moneyness

Moneyness is a measure of the distance of the strike price in relation to the underlying price. Delta will decrease the further away the strike price is from the underlying. Far out-of-the-money options have delta values close to 0 while deep in-the-money options have deltas that are close to 1. An at-the-money option will generally have a delta of 0.5.

The greater the intrinsic value of the option, the higher the option delta.

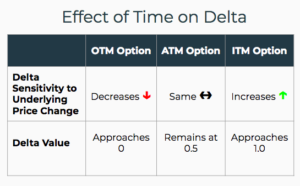

Time

As the time to expiration of the option changes, in-the-money options become more sensitive to changes in the underlying price. Delta will trend toward 1 for calls and -1 for puts. Conversely, out-of-the-money options become less sensitive to change in the underlying and delta approaches zero for both calls and puts. Delta for at-the-money options remains relatively unchanged.

All other factors being equal, the effect of delta based on the time remaining will affect how you trade. For instance, shorting an OTM option may be more attractive since delta is closer to 0. Any big change in the stock price would have a relatively low effect on the option price since delta would not react strongly. Compare this to the sale of a deep ITM option - any big change in the underlying would have a large effect of the option since delta is approaching 1.0. A deep itm call option close to expiration would increase by $1 when the underlying increased $1. This scenario would be unprofitable when you are short.

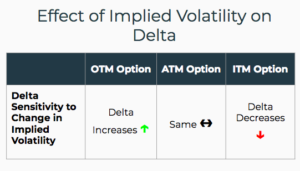

Volatility

A change in implied volatility (IV) of the option will change the delta based on the moneyness of the option.

ATM options delta remains relatively unchanged with a spike in IV. ITM options delta decreases. OTM options delta increases as IV increases.

Again, how delta responds to an increase in IV will effect how you trade. If you are short an OTM option and their is a spike in IV then delta will increase. Any subsequent change in the underlying will have a large effect on the option price.

References:

(1) Delta and the Moneyness of Options by the Blue Collar Investor

(2) Option Delta by Macroption

(3) Delta by The Options Guide

(4) Behavior of Delta in Relation to Time Remaining to Expiration by Option Trading Beginner

(5) Behavior of Delta in Relation to Implied Volatility (IV) by Option Trading Beginner